In the fast-paced world of trading, understanding when a trend is about to reverse can be the key to maximizing profits and minimizing losses. The market is often unpredictable, and identifying the right moment to enter or exit a trade is crucial for success. This is where trend reversal indicators come into play. In this comprehensive guide, we will explore the best trend reversal indicators available, their applications, and how they can enhance your trading strategy.

As traders navigate through various market conditions, having reliable tools to identify trend reversals can make a significant difference. This article will delve into the most effective indicators that traders can utilize to spot potential reversals, along with practical tips and techniques for integrating them into your trading routine. Whether you are a seasoned trader or just starting, understanding these indicators can provide valuable insights into market dynamics.

By the end of this article, you will not only grasp the concept of trend reversal indicators but also be equipped with the knowledge to select and apply the best ones for your trading style. So, let’s dive into the world of trend reversal indicators and uncover the strategies that can lead you to trading success!

Table of Contents

- What Are Trend Reversal Indicators?

- Importance of Trend Reversal Indicators

- Top Trend Reversal Indicators

- 1. Moving Averages

- 2. Relative Strength Index (RSI)

- 3. Moving Average Convergence Divergence (MACD)

- 4. Bollinger Bands

- How to Use Trend Reversal Indicators

- Common Mistakes to Avoid

- Case Studies of Trend Reversal Indicators in Action

- Conclusion

What Are Trend Reversal Indicators?

Trend reversal indicators are tools used by traders to predict potential changes in the direction of market trends. These indicators analyze price movements and patterns to identify points where a prevailing trend may be losing momentum, signaling a possible reversal. By recognizing these points, traders can make informed decisions about when to enter or exit trades.

Importance of Trend Reversal Indicators

The significance of trend reversal indicators cannot be overstated. Here are some key reasons why they are essential in trading:

- **Enhanced Decision Making**: By providing insights into market conditions, these indicators help traders make more informed decisions.

- **Risk Management**: Identifying potential reversals allows traders to set appropriate stop-loss orders, protecting their investments.

- **Profit Maximization**: By entering trades at the right moment, traders can capitalize on price movements, maximizing their profits.

- **Market Awareness**: These indicators keep traders updated on market trends, allowing them to adapt their strategies accordingly.

Top Trend Reversal Indicators

Let’s explore some of the best trend reversal indicators that traders can utilize:

1. Moving Averages

Moving averages are one of the most commonly used indicators in technical analysis. They smooth out price data to identify the direction of the trend. Traders often use two types of moving averages:

- **Simple Moving Average (SMA)**: Averages the closing prices over a specified period.

- **Exponential Moving Average (EMA)**: Gives more weight to recent prices, making it more responsive to price changes.

When a short-term moving average crosses above a long-term moving average, it may indicate a bullish reversal, while a cross below may indicate a bearish reversal.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. The RSI ranges from 0 to 100 and is typically used to identify overbought or oversold conditions. A reading above 70 may indicate that a security is overbought, while a reading below 30 may suggest that it is oversold. These conditions often precede trend reversals.

3. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, signal line, and histogram. When the MACD line crosses above the signal line, it may indicate a bullish reversal, and when it crosses below, it may indicate a bearish reversal.

4. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent standard deviations from the SMA. These bands expand and contract based on market volatility. When prices touch the lower band, it may indicate an oversold condition and a potential bullish reversal. Conversely, when prices touch the upper band, it may indicate an overbought condition and a potential bearish reversal.

How to Use Trend Reversal Indicators

To effectively use trend reversal indicators, traders should consider the following steps:

- **Combine Indicators**: Use multiple indicators together to confirm signals and reduce false positives.

- **Analyze Price Action**: Look for price patterns and candlestick formations that support the signals given by the indicators.

- **Set Stop-Loss Orders**: Always set stop-loss orders to protect against unexpected market movements.

- **Practice Risk Management**: Only risk a small portion of your capital on any single trade to minimize potential losses.

Common Mistakes to Avoid

Traders often make several common mistakes when using trend reversal indicators. Here are a few to watch out for:

- **Overreliance on Indicators**: Relying solely on indicators without considering market context can lead to poor decisions.

- **Ignoring Market News**: Economic news and events can significantly impact market trends, so stay informed.

- **Lack of Backtesting**: Always backtest your strategies with historical data to understand their effectiveness.

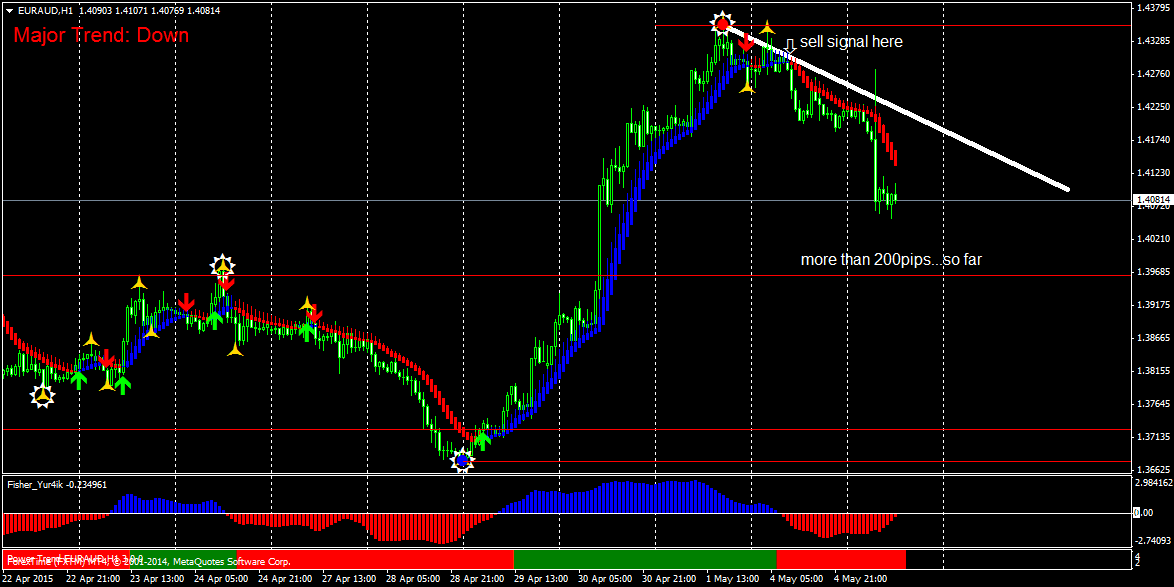

Case Studies of Trend Reversal Indicators in Action

To illustrate the effectiveness of trend reversal indicators, here are a couple of case studies:

- **Case Study 1**: A trader used the RSI and MACD indicators to identify a bullish reversal in a stock. The RSI showed an oversold condition, while the MACD indicated a crossover. The trader entered the trade and capitalized on the subsequent price increase.

- **Case Study 2**: Another trader applied Bollinger Bands to a currency pair. When the price touched the lower band, it signaled a potential reversal. The trader entered a long position, and the price subsequently moved upwards, resulting in a profitable trade.

Conclusion

In conclusion, trend reversal indicators are invaluable tools for traders seeking to optimize their trading strategies. By understanding and effectively utilizing indicators such as moving averages, RSI, MACD, and Bollinger Bands, traders can enhance their ability to identify potential market reversals. Remember to combine indicators, analyze price action, and practice sound risk management to maximize your trading success.

We encourage you to leave a comment below with your thoughts on trend reversal indicators or to share your experiences. Don’t forget to explore our other articles for more insights into trading strategies!

Thank you for reading, and we look forward to seeing you back on our site for more valuable trading information.

You Might Also Like

M1A SOCOM With Scope: A Comprehensive GuideInsperity Nashville: Empowering Businesses With Comprehensive HR Solutions

Understanding The Simple Commercial Sublease Agreement: A Complete Guide

Pole Barn Builders In Southern Illinois: Your Ultimate Guide

Understanding Dollar General Scrubs: Your Ultimate Guide

Article Recommendations