In the world of trading, identifying market reversals is crucial for maximizing profits and minimizing losses. The best reversal indicator can be a game-changer for both novice and experienced traders alike. With the right tools and knowledge, traders can pinpoint potential turning points in the market, enabling them to make informed decisions. In this comprehensive guide, we will delve into the best reversal indicators available, their functionalities, and how to effectively utilize them in your trading strategy.

Understanding market trends and reversals is an essential skill for any trader. Whether you are trading stocks, forex, or cryptocurrencies, having a reliable reversal indicator can help you navigate the often volatile markets. In this article, we will explore various types of reversal indicators, their advantages and disadvantages, and how to implement them in your trading plan.

As we journey through the intricacies of reversal indicators, we will also highlight the importance of expertise, authoritativeness, and trustworthiness (E-E-A-T) in the trading realm. By the end of this article, you will be equipped with the knowledge needed to select the best reversal indicator for your trading style and goals.

Table of Contents

- What is a Reversal Indicator?

- Importance of Reversal Indicators in Trading

- Top Reversal Indicators

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

- Stochastic Oscillator

- Bollinger Bands

- How to Use Reversal Indicators Effectively

- Common Mistakes to Avoid When Using Reversal Indicators

- Real-Life Examples of Successful Reversal Trading

- Conclusion

What is a Reversal Indicator?

A reversal indicator is a technical analysis tool that signals potential price reversals in financial markets. These indicators help traders identify when an asset is likely to change direction, either from an uptrend to a downtrend or vice versa. By utilizing reversal indicators, traders can make informed decisions about when to enter or exit trades, ultimately enhancing their trading performance.

Importance of Reversal Indicators in Trading

Reversal indicators play a vital role in trading strategies for several reasons:

- Timely Decision Making: They provide traders with timely signals to enter or exit trades.

- Risk Management: By identifying potential reversals, traders can set stop-loss orders effectively.

- Market Insights: Reversal indicators help traders analyze market momentum and sentiment.

Top Reversal Indicators

Now that we understand the significance of reversal indicators, let's explore some of the best options available for traders:

1. Moving Average Convergence Divergence (MACD)

The MACD is a popular trend-following momentum indicator that shows the relationship between two moving averages of an asset's price. It consists of three components:

- MACD Line: The difference between the 12-day and 26-day exponential moving averages (EMAs).

- Signal Line: The 9-day EMA of the MACD line.

- Histogram: The difference between the MACD line and the signal line.

Traders look for bullish or bearish crossover signals between the MACD line and the signal line to identify potential reversals.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions:

- Overbought Condition: An RSI above 70 may indicate that an asset is overbought and due for a reversal.

- Oversold Condition: An RSI below 30 suggests that an asset is oversold and may reverse upwards.

3. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of an asset to a range of its prices over a specific period. It generates values between 0 and 100. Key levels to watch include:

- Above 80: Overbought conditions.

- Below 20: Oversold conditions.

Traders often look for divergence between the indicator and price action to confirm potential reversals.

4. Bollinger Bands

Bollinger Bands consist of a middle band (simple moving average) and two outer bands (standard deviations). When prices touch the upper band, it may indicate overbought conditions, while touching the lower band suggests oversold conditions. A price reversal is often anticipated when the price moves toward the opposite band.

How to Use Reversal Indicators Effectively

To maximize the benefits of reversal indicators, consider the following strategies:

- Combine Indicators: Use multiple indicators together to confirm signals and reduce false positives.

- Set Clear Entry and Exit Points: Establish specific price levels for entering and exiting trades based on indicator signals.

- Backtest Your Strategies: Test your trading strategy on historical data to assess its effectiveness before applying it to live trading.

Common Mistakes to Avoid When Using Reversal Indicators

While reversal indicators are valuable tools, traders should avoid common pitfalls:

- Ignoring Market Context: Always consider the overall market trend before relying solely on indicators.

- Overtrading: Avoid making impulsive trades based on signals without proper analysis.

- Neglecting Risk Management: Always implement stop-loss orders to protect your capital.

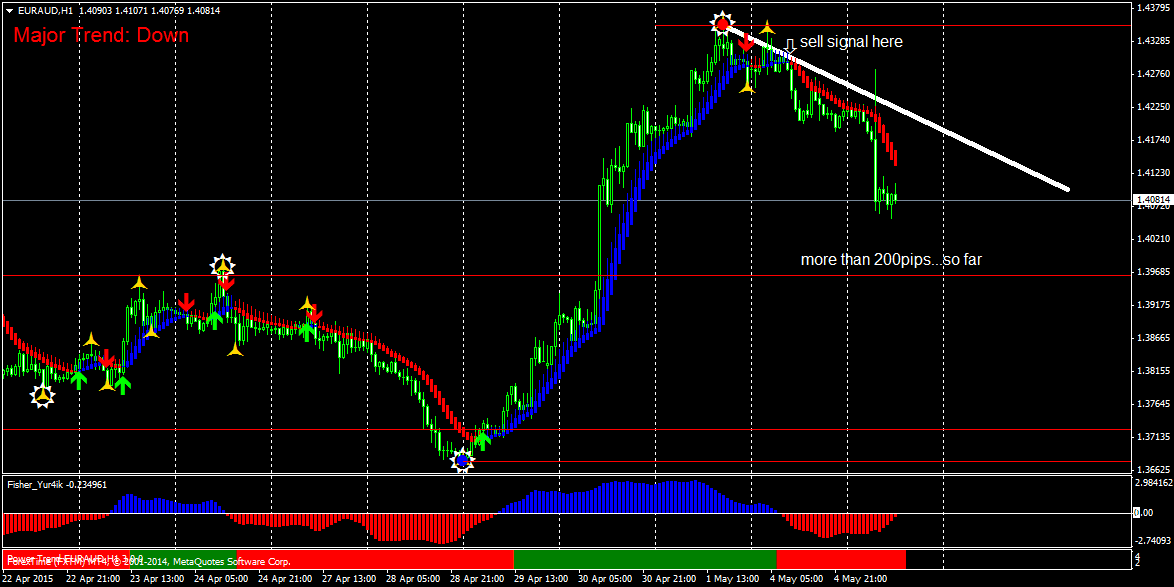

Real-Life Examples of Successful Reversal Trading

Let’s look at a couple of real-life scenarios where traders successfully utilized reversal indicators:

- Example 1: A trader noticed a MACD crossover while the RSI was approaching the oversold level. This confirmed a potential bullish reversal, leading to a profitable trade.

- Example 2: After observing a price touching the lower Bollinger Band coupled with a bullish divergence on the Stochastic Oscillator, a trader entered a long position with a favorable risk-to-reward ratio.

Conclusion

In conclusion, the best reversal indicators are essential tools for traders aiming to identify potential market turning points. By understanding the functionalities of indicators like MACD, RSI, Stochastic Oscillator, and Bollinger Bands, traders can enhance their decision-making processes. Remember to combine these indicators with sound risk management practices and market analysis for optimal results. We encourage you to leave comments below, share this article, or explore more content on our site to further expand your trading knowledge.

Call to Action

Join our trading community and stay updated with the latest insights, strategies, and tips to elevate your trading skills. Don’t forget to bookmark our site for future reference!

Thank you for reading, and we look forward to seeing you again soon!

You Might Also Like

Understanding Freightliner SPN Codes: A Comprehensive GuideUltimate Guide To The Minute Maid Seating Chart: Everything You Need To Know

Wrigley Field Seating Map: Your Ultimate Guide To Choosing The Best Seats

Understanding Uber Estimate: A Comprehensive Guide To Ride Cost Calculation

Exploring The Intriguing World Of F/M Spanking Stories

Article Recommendations