The PPP Loan Warrant List 2024 has become a crucial topic for many businesses and individuals seeking financial assistance in the wake of economic challenges. As we navigate through uncertain times, understanding the intricacies of the Paycheck Protection Program (PPP) is vital. This article aims to provide comprehensive insights into the PPP Loan Warrant List for 2024, including its significance, eligibility criteria, and the application process.

In this article, we will delve deep into the PPP Loan Warrant List, exploring its implications for borrowers and lenders alike. Whether you are a small business owner, an entrepreneur, or simply interested in financial assistance options, this guide will serve as a valuable resource. We will also analyze the latest updates and changes introduced in 2024 that may affect your eligibility and application process.

Stay with us as we uncover essential details about the PPP Loan Warrant List, providing you with expert insights and authoritative information to help you navigate your financial journey effectively.

Table of Contents

- What is the PPP Loan?

- Importance of the PPP Loan Warrant List

- Eligibility Criteria for the PPP Loan

- How to Apply for the PPP Loan

- PPP Loan Warrant List 2024 Updates

- Impact of PPP Loans on Small Businesses

- Common Mistakes to Avoid in the Application Process

- Conclusion

What is the PPP Loan?

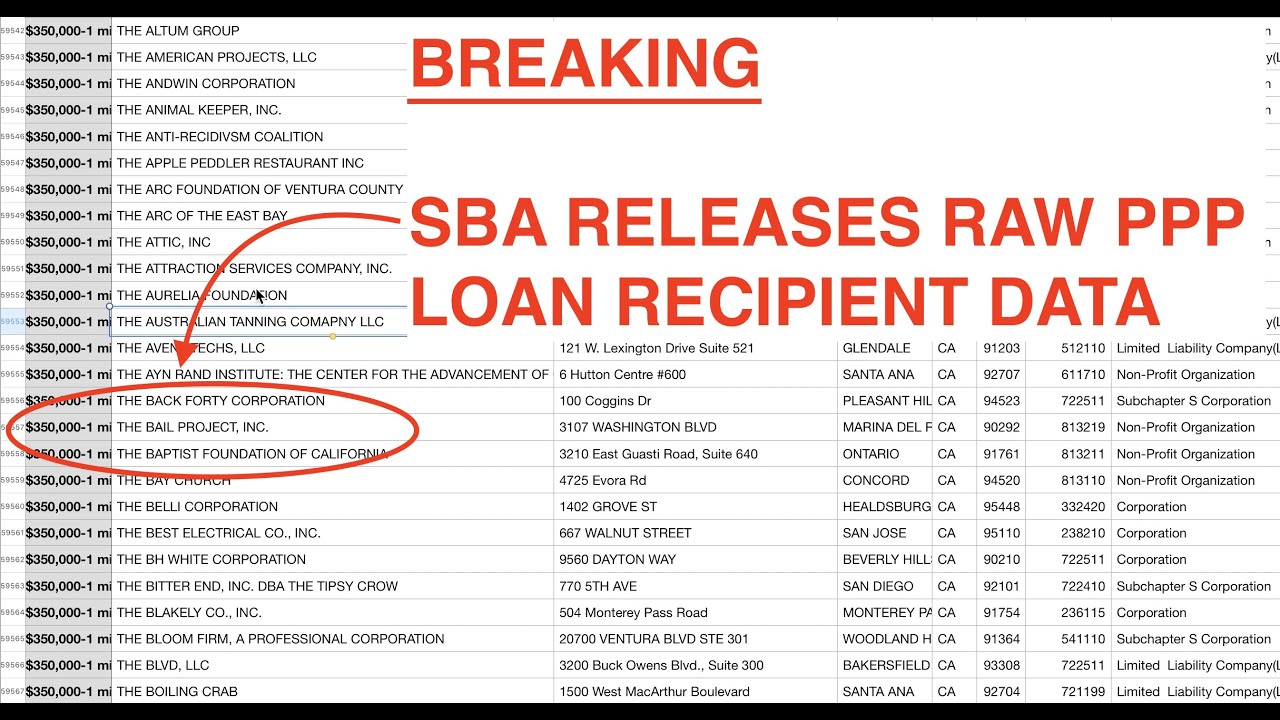

The Paycheck Protection Program (PPP) was established by the U.S. government to provide financial assistance to small businesses affected by the COVID-19 pandemic. The program aims to help businesses retain their employees and cover essential expenses. The PPP loan is designed to be forgivable, provided that certain conditions are met, making it an attractive option for businesses in need of financial support.

Importance of the PPP Loan Warrant List

The PPP Loan Warrant List serves as a vital resource for lenders and borrowers. It provides transparency regarding which loans are backed by warrants, ensuring accountability and protection for both parties involved. Understanding the warrant list is crucial for businesses seeking to apply for PPP loans, as it outlines the terms and conditions associated with the loans.

Key Benefits of the PPP Loan Warrant List

- Increased transparency in the lending process.

- Protection for lenders against defaults.

- Enhanced trust between borrowers and lenders.

- Access to critical information for financial decision-making.

Eligibility Criteria for the PPP Loan

To qualify for a PPP loan, businesses must meet specific eligibility criteria. These criteria have been updated for 2024, reflecting the changing economic landscape. Below are the primary eligibility requirements:

- Must be a small business with fewer than 500 employees.

- Must have been in operation on or before February 15, 2020.

- Must demonstrate a reduction in revenue due to the COVID-19 pandemic.

- Must use the loan for eligible expenses, such as payroll, rent, and utilities.

How to Apply for the PPP Loan

Applying for a PPP loan involves several steps. It is essential to prepare all necessary documentation to ensure a smooth application process. Here’s a step-by-step guide to applying for a PPP loan:

- Determine your eligibility based on the criteria mentioned above.

- Gather required documentation, including payroll records, tax filings, and financial statements.

- Contact an approved lender to initiate the application process.

- Complete the PPP loan application form accurately.

- Submit your application and documentation to the lender.

PPP Loan Warrant List 2024 Updates

As of 2024, several updates have been made to the PPP Loan Warrant List. These updates aim to streamline the application process and enhance the program's effectiveness. Key changes include:

- Revised eligibility criteria to accommodate more businesses.

- Increased loan amounts available for qualifying businesses.

- Extended application deadlines to provide additional support.

- Enhanced guidance for lenders on processing applications.

Impact of PPP Loans on Small Businesses

The impact of PPP loans on small businesses has been significant. Many businesses have been able to retain employees, cover operational costs, and stay afloat during challenging times. According to recent data, over 5 million PPP loans have been approved, providing crucial support to businesses across the country.

Statistics on PPP Loan Impact

- Estimated jobs saved: 51 million

- Total funds disbursed: $800 billion

- Percentage of businesses reporting financial stability post-loan: 70%

Common Mistakes to Avoid in the Application Process

When applying for a PPP loan, several common mistakes can hinder your chances of approval. Avoid the following pitfalls:

- Incomplete or inaccurate application forms.

- Failure to provide necessary supporting documentation.

- Not understanding the loan terms and conditions.

- Missing deadlines for application submission.

Conclusion

In conclusion, the PPP Loan Warrant List 2024 provides essential insights into the eligibility, application process, and impact of PPP loans on small businesses. Understanding these aspects is critical for anyone looking to secure financial assistance during challenging times. We encourage readers to stay informed and take action by applying for PPP loans if eligible.

We invite you to share your thoughts and experiences in the comments below. If you found this article helpful, consider sharing it with others who may benefit from this information. For more insights on financial assistance and business support, explore our other articles.

Thank you for reading, and we look forward to providing you with more valuable content in the future!

You Might Also Like

Aryana Rose: The Rising Star Of The Music IndustryDebra Bollman: A Deep Dive Into Her Life And Career

Lloyd Kwanten: The Rising Star Of The Entertainment Industry

Understanding The Reasons Behind Neo Leshabane's Divorce

5-17 Telegram: A Comprehensive Guide To Understanding Its Impact

Article Recommendations